Partner with Bizcap to empower SMEs

With our commitment to saying “yes” more often, we work with brokers to provide fast access to flexible funding for their small and medium-sized business clients.

Get accredited with Bizcap today.

If you’re a broker, adviser or referral partner, get in touch to find out how we can tailor financing to your SME clients.

With a commitment to saying “yes” more often, we can assist businesses that need funds fast to meet cash flow obligations or seize growth opportunities.

We also welcome businesses with poor credit scores and existing financing while offering industry-leading commissions for every successful deal funded.

Since the company’s inception in 2019, Bizcap has provided more than 66,000 SME funding solutions across Canada, Australia, New Zealand, Singapore, Europe and the UK, totalling more than $3 billion.

Unlike traditional providers, Bizcap embraces an innovative revenue-focused assessment and risk evaluation methodology, considering both qualitative and quantitative factors, which allows us to say “yes” more often. We offer fast access to capital, supporting businesses in times of exciting growth or financial need.

Are you struggling to find fast and flexible funding solutions for your clients? Do you need reliable support to help businesses overcome financial challenges? Join us for a complimentary 1-on-1 session with Chief Revenue Officer Bruce Gurvitsch and learn how to effortlessly leverage Bizcap's products for optimal client results.

Submit your clients’ details using our Partner Portal and get live access to the deal flow. We’ll quickly assess your client’s information and provide a conditional offer in as little as 3 hours. After the offer is accepted and the funding is delivered, we’ll process your commission promptly.

We like to keep things simple. Our seamless end-to-end processes have enabled us to provide funding to more than 66,000 business clients while retaining a 4.8 out of 5 Trustpilot rating. By partnering with Bizcap, you’ll give your clients access to fast, flexible and forward-thinking funding.

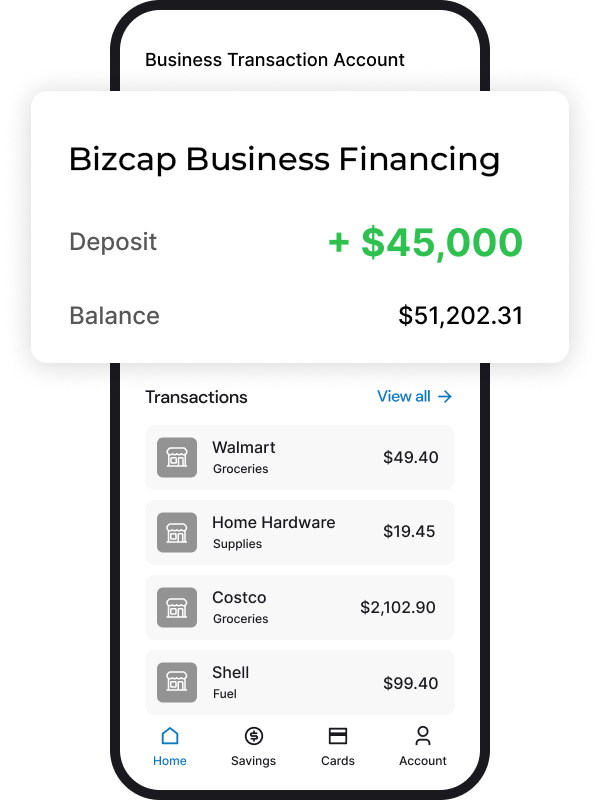

Bizcap specialises in providing fast and flexible business financing to small and medium-sized businesses. Our solutions include Revenue Based Financing and Line of Capital. Our financing sizes vary from $10,000 to $2,000,000.

Bizcap offers business funding of $10,000 to $2,000,000. To find out more about each of our funding solutions, contact us and we'll guide you through your options.The specific amount of your client’s funding is influenced by factors such as the business’s revenue performance, operational duration and funding purpose.

We assess these aspects to gauge the business’s health and viability. Our aim is to offer tailored funding solutions that address each business’s unique operational needs while minimizing risk for all parties. By evaluating the factors that contribute to your client’s business health, we determine an appropriate funding amount and structure to support sustained growth and success.

Pre-funding:

If your client is not satisfied with the initial funding offer, please contact us to explain their specific needs. We will work collaboratively with you to address them.

Post-funding:

Customers are eligible for renewal once 50 percent of the funding agreement has been completed. Additional capital may also be available on a case-by-case basis, assuming strong performance.

We regularly check in with our customers to see whether they need access to more capital. If you have a client who you know would like additional funding, please contact us directly.

At Bizcap, we pride ourselves on providing fast and flexible business funding. Applications for Bizcap's Revenue Based Financing can be approved within 3 hours and funded the same day. If your client needs capital sooner, let your Business Development Manager know and we can fast-track the application.

Our financing solutions are paid through daily or weekly direct debits from the business’s bank account (excluding weekends and holidays) for a projected payment horizon of 5 to 12 months.

There are two ways to fund deals with Bizcap:

1. Hands-Free Referrals: Diversify your business without becoming an expert in small business financing. Simply refer clients to us and a dedicated Financing Specialist will support them from application to funding, while keeping you in the loop. We have a higher conversion rate when our Financing Specialists close the deals on your behalf.

2. Broker Managed: Prefer to handle the relationship with your clients? We’ll educate you in our solutions and connect you with a Business Development Manager to help you close the deal.

Our primary considerations include:

- The overall health of the businesses cash flow

- The businesses average end-of-day balances

- Frequency and volume of monthly deposits

Our secondary considerations include:

- Time in business. To be eligible for a financing solution, most businesses need to have a time in business of at least 6 months

- Payment history with other funders

Bizcap is the most open-minded funder in Australia, New Zealand, Singapore, the United Kingdom, Luxembourg and now Canada. Our efficient end-to-end processes enable us to offer financing incredibly fast, approving them in as little as 3 hours with same day funding.

We tailor financing to the individual needs of each business and offer cash flow-friendly debit solutions. Clients who need bridging finance can secure financing at heavily discounted rates. Dedicated to saying “yes” more often, we welcome businesses with poor credit scores, existing financing, including those who have been rejected by other funders.

Our clients are overwhelmingly satisfied with our products and services, accrediting us with a 4.8/5 Trustpilot rating.

In recognition of our partners’ expertise, we offer industry-leading commissions.

We are happy to discuss any circumstance with you. Simply call us or fill out the Partner form above, and we can review the scenario together. As part of our assessment, we may conduct a soft credit inquiry, which does not affect your client’s credit score.

There are various scenarios in which small and medium-sized businesses come to us for funding. They may be experiencing cash flow pressure or looking to grow their business. Some are facing a short-term opportunity and need capital quickly. SMEs also come to us after being declined by another funder for a range of reasons, including a low credit score or existing funding elsewhere.

These business owners contact Bizcap knowing we are Canada’s most open-minded funder. With our commitment to saying “yes” more often, we review a combination of qualitative and quantitative factors to assess business performance and provide solutions that address their operational needs while offering cash flow-friendly debits.

We also support customers who have received funding from other providers but not as much as they required, and are seeking additional capital to move their business forward.

Bizcap can support deals that other funders may not, thanks to our innovative business assessment and risk evaluation methodology, which considers a wide range of qualitative and quantitative factors. We can also do this because we are a direct funder and self-funded, which removes much of the red tape that typically slows down the funding process.

Brokers avoid shopping around for the best loan offer out of an understandable concern that doing so would result in multiple credit checks for their client. Each credit check, or "hard inquiry," can slightly lower their score. What’s more, some lenders view multiple credit inquiries within a short period as a sign of financial instability.

At Bizcap, we can make an initial offer without running a credit check, which makes applying for a loan completely risk-free.

Only once the client decides to proceed with the loan do we run a hard inquiry to finalise the offer. If you’d like to find out how much your client would be eligible for, email us at partners@bizcap.lu for an obligation-free offer today.

.svg)