Get business

financing for what comes next

Where small business grows big

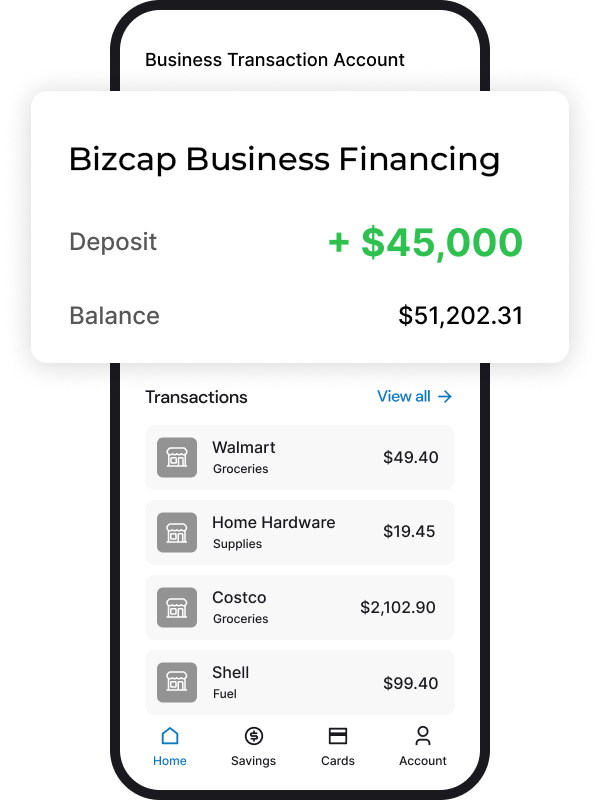

Business financing

made simple

Application

Assessment

Funding

Award-winning business financing and service

Canada's most open-minded funder

Get funds and move on

Fast and friendly

High approval rates

No obligation

Flexible payments

.svg)

Early payment discounts

Why small businesses keep coming back

Help your clients secure fast, flexible funding when they need it most

Get in Touch

What type of financing does Bizcap offer?

Bizcap provides fast and flexible business funding solutions for small and medium-sized businesses. Our models include Revenue Based Financing (RBF) and Line of Capital (LOC). Our financing sizes vary from $10,000 to $2,000,000.

How much can I access from Bizcap?

Bizcap offers business funding from $10,000 to $2,000,000. To learn more about each option, contact us for a no-obligation conversation about your needs.

Your funding amount is based on factors such as your business’s revenue performance and time in business. We review these to understand your overall business health and provide the most suitable funding model.

Our goal is to deliver tailored funding that aligns with each business’s unique operational needs, helping support sustainable growth.

How quickly can I get funds into my account?

Bizcap provides fast and flexible SME business funding. Applications can be approved within 3 hours with same day funding available. Delays can occur if information or supporting documents are incomplete. Providing accurate and complete documentation helps ensure funding moves quickly.

How can Bizcap fund my business faster than other capital providers?

Bizcap stands out for speed when delivering working capital. Because we are a direct funder and self-funded, we avoid the administrative barriers often seen with traditional providers. Our streamlined application, assessment and end-to-end processes allow us to move quickly.

Traditional banks may take weeks to provide an outcome for business funding. Other funders may still take several days to complete their processes. Bizcap can provide access to capital as early as the next day after approval, making us one of the fastest business funding partners across Europe, Singapore, the U.K., Australia and New Zealand.

What can delay my business funding application?

Delays usually occur when required documentation is missing. You will need to submit your business bank statements as part of your application. After a conditional offer, additional documents may be required. The sooner these are provided, the sooner we can issue a suitable business funding solution.

Bizcap is a low doc solution, meaning we require fewer documents compared to banks and other funders. This helps accelerate the process, although timely submission of requested documents remains essential.

How does the process work?

We use proprietary technology and extensive funding experience to provide solutions for businesses across many industries.

After you complete your application, including your details and business bank statements, we assess your file and issue a conditional offer.

Once you confirm that the funding details suit your needs, we may collect a small amount of extra information to issue an unconditional offer. Funds are often released the same day.

What are Bizcap’s rates and fees, and how are they determined?

We consider each applicant’s revenue performance, financial history and overall business strength to determine a cost structure that aligns with the applicant’s profile. Debits are based on factors such as the amount and consistency of the business’s revenue, the years in operation, the business’s assets and the proposed use of funds.

We charge an underwriting fee, which is disclosed upfront. We also offer a discount for completing your RBF early.

What criteria do I need to meet to apply for funding with Bizcap?

Bizcap has clear minimum eligibility criteria to ensure our solutions remain accessible to a wide range of businesses.

For Bizcap’s Revenue Based Financing or Line of Capital, you will need:

1. An active Canadian Business Number (BN).

2. At least 6 months of business history.

3. Monthly revenue of at least $20,000.

By meeting these criteria, you can confidently apply for working capital with Bizcap. For information on upcoming products or general queries, contact us for an obligation-free conversation.

What factors affect my application and approval?

Approval is influenced by time in business, revenue history, industry, the business owner’s profile and other relevant factors. This approach helps us understand your business deeply and support you in ways many funders cannot.

What if I only need business funding for a few weeks?

Bizcap can support bridge-capital needs with its Revenue Based Financing which is ideal for bridging timing gaps, quick purchases or other immediate requirements.

If you only need funding for a brief period, let us know and we can structure your model accordingly. Businesses that qualify may also access our Line of Capital.

We encourage responsible use of capital and offer discounts for completing your agreement early.

What can I use the funds for?

Funds can be used for almost any business purpose, including:

1. purchasing stock, inventory or equipment

2. marketing

3. hiring staff

4. operational expenses

5. expansion

6. renovation or unexpected repairs

7. growth and cash flow support

What are Bizcap’s cost structures and how are they determined?

The cost of funding with Bizcap is based on a factor rate, which is a fixed fee applied to your funding model. The factor rate is influenced by your business performance, time in business and intended use of funds.

As your relationship with Bizcap strengthens and your business demonstrates consistent performance, your factor rate may improve over time.

.png)